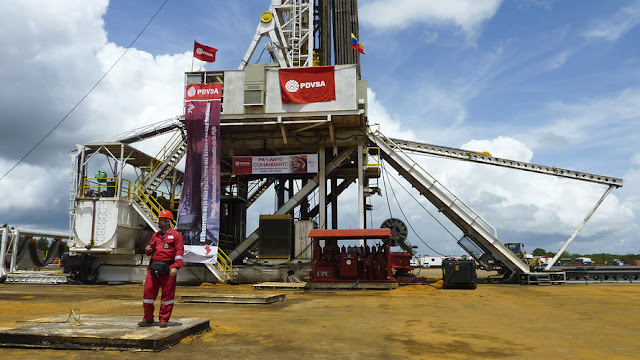

Fitch Ratings said default for Venezuela’s state-owned oil and gas firm PDVSA is “probable.”

By : MyraP. Saefon

Venezuela’s oil production is poised for a significant decline in the months ahead—and that has nothing to do with its pledge to cut output as an OPEC member.

As the country with the world’s largest proven oil reserves, Venezuela has the potential to influence the oil markets in a big way.

“While Venezuela has a ton of oil underneath it, unfortunately for them, they have one of the highest costs [a] barrel to lift and process it,” among the Organization of the Petroleum Exporting members, said Tyler Richey co-editor of The Sevens Report.

Venezuela’s proved oil reserves was estimated at 300.9 billion barrels at the end of 2015, according to BP’s BP, -0.32% Statistical Revenue of World Energy June 2016. That’s below Saudi Arabia’s 266.6 billion and much less than the U.S.’s 55 billion.

But it cost Venezuela about $27.62 to produce a barrel of oil and natural gas in 2016, according to a story published by WSJ News Graphics last year, which cites data from Rystad Energy UCube. That ranks it as fourth in terms of major producers who pay the most to get the commodities out of the ground.

And profits have been cut significantly in recent years. Prices for the global benchmark Brent crude LCOK7, +0.53% trade at around $55 a barrel, down by about half from a high of roughly $113 in June of 2014. West Texas Intermediate CLJ7, +0.48% trades close to $53 a barrel, down from about $106 almost three years ago.

When oil prices were in the $100s, “the Venezuela government was able to make things work, but now with prices as low as they are,” production has dropped, said Richey. “They have a serious budget problem on their hands.”

Venezuela has only $10.5 billion in foreign reserves left for the rest of the year, it owes about $7.2 billion in outstanding debt payments, according to a CNN report published this week. Those figures suggest that nation could soon run out of cash.

When it comes to oil production, Venezuela is “still profitable,” said Richey. “However, they had produced aggressive budgets based on oil price forecasts calling for $100+/barrel, and now with revenues half of what they had expected ... they are deep in the red.”

In a Jan. 31 report, Fitch Ratings said that Petróleos de Venezuela S.A. faces a challenging year and that default for the state-owned oil and natural-gas company is “probable”—in part, due to “moderate” oil price increase, lower production and a weak liquidity position.

The big problem is that under Hugo Chávez, who served as president from 1999 to 2013, and the current President Nicolás Maduro, Venezuela has “failed to use either the money from [oil] exports or the loans from China and Russia to reinvest in new wells,” said James Williams, energy economist at WTRG Economics.

“Their policies have chased most of the oil and gas investors out of the country,” he said.

Williams said many of the service companies won’t do business with Venezuela or have scaled back their operations, such as Schlumberger Ltd. SLB, -1.60% and Halliburton Co. HAL, -1.52%

In April of last year, Schlumberger said it would reduce activity in the country, partly because of “insufficient payments received in recent quarters.”

Venezuela’s oil production has fallen by about a million barrels a day since Chávez was elected, said Williams.

“The primary reason is the failure to invest enough of the proceeds in drilling,” he said. “Lack of money and lack of infrastructure improvements have led to further cuts in production. In other words, there has been failure at every level to support Venezuelan production.”

Given all of that, the nation’s oil output is likely to “continue to deteriorate,” said Williams.

This chart from Trading Economics shows that Venezuela’s oil production was pegged at about 2.25 million barrels a day in January.

For the record, however, that is still above the output of 1.972 million barrels a day it’s supposed to target as a part of the OPEC-led production cut agreement that kicked in at the start of the year.

But just to maintain current production, Williams said he believes the country needs an active oil-rig count of at least 70.

Data from Baker Hughes BHI, -1.80% show Venezuela’s oil rig count at 50 in January of this year, down from 71 in March of 2016.

“I think at a minimum, it will lose at least another 200,000 b/d to 300,000 barrels per day,” said Williams. “Assuming Maduro is still in office, by end of the year we expect Venezuelan production between 1.7 and 1.8 million barrels per day.”

No comments:

Post a Comment